Infosys Q4 FY25 Performance: A Detailed Analysis

Infosys Ltd. (NSE: INFY), India’s second-largest IT services company, reported its Q4 FY24 financial results on April 18, 2024, triggering significant market debate. Below, we unpack every critical detail from the earnings report, management commentary, and analyst perspectives to answer the pressing question: Should you buy, sell, or hold Infosys shares?

Infosys, a leading name in India’s IT sector, recently unveiled its financial outcomes for the fourth quarter of the fiscal year 2024-25. The report presents a complex interplay of growth and contraction, set against a backdrop of global economic uncertainties. This analysis delves into the specifics of Infosys’s performance, the market’s reaction, and the broader implications for the IT industry.

Financial Performance Breakdown

1. Revenue Analysis

- Q4 FY24 Revenue: ₹37,923 crore ($4.5 billion)

- Full-Year FY24 Revenue:

Why Revenue Declined QoQ?

- Client budget cuts in BFSI (Banking, Financial Services, Insurance) and retail sectors (30% of revenue combined).

- Delayed decision-making on large deals, especially in the U.S. market.

2. Profitability Metrics

- Operating Margin (Q4): 20.1% (down 70 basis points from 20.8% in Q3 FY24).

- Net Profit (Q4): ₹7,975 crore, a 30% YoY jump (boosted by tax credits and reduced subcontractor costs).

- FY24 Operating Margin: 20.7% (up 40 bps YoY), meeting the company’s guidance of 20-22%.

3. Client Engagement & Deal Pipeline

- Large Deal Wins (Q4): Total Contract Value (TCV) of $4.5 billion (highest in 8 quarters).

- Active Clients: 1,857 (down by 3 QoQ, reflecting consolidation of accounts).

- Deal Pipeline for FY25: $7.2 billion (15% higher than Q4 FY23).

Market Reaction: ADR Shares Under Pressure

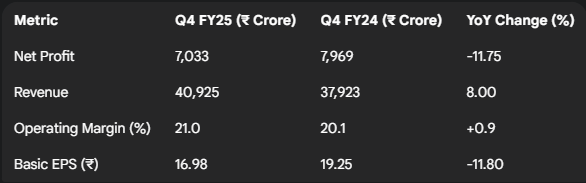

The release of the Q4 FY25 results triggered a notable response in the financial markets. On the New York Stock Exchange (NYSE), Infosys’s American Depository Receipt (ADR) shares experienced a decline of over 4% at the commencement of trading on April 17, 2025. This downturn reflects investor apprehension regarding the company’s net profit, which saw an 11.75% year-over-year decrease, falling from ₹7,969 crore to ₹7,033 crore. This market behaviour underscores the sensitivity of international investors to the financial health and future prospects of major Indian IT firms like Infosys, which derive a substantial portion of their revenue from the US market.

FY25 Guidance: Why the Market is Nervous

Infosys issued a cautious outlook for FY25, far below street expectations:

- Revenue Growth: 1–3% in constant currency terms (vs. 4–7% in FY24).

- Operating Margin: 20–22% (flat vs. FY24 guidance).

Reasons Behind the Weak Guidance:

- Macroeconomic Uncertainty: Clients in the U.S. and Europe are delaying non-essential IT projects.

- Reduced Discretionary Spending: Only 65% of the FY25 pipeline is “committed spend” vs. 75% in FY24.

- Attrition Challenges: Despite hiring freezes, attrition rose to 12.6% in Q4 (vs. 12% in Q3).

Key Financial Highlights

Infosys’s Q4 FY25 results present a combination of positive and negative trends:

- Revenue Growth: The company’s revenue from core operations increased by 8%, rising to ₹40,925 crore from ₹37,923 crore in the same quarter of the previous fiscal year. In constant currency terms, revenue grew by 4.8% year-over-year.

- Profitability Decline: Net profit experienced a significant decline of 11.75% year-over-year.

- Sequential Revenue Contraction: On a sequential basis, revenue in constant currency terms decreased by 3.5% compared to the previous quarter.

- Operating Margin: The operating margin stood at 21.0%, showing a 0.9% increase year-over-year but a 0.3% decrease quarter-over-quarter.

- Earnings Per Share (EPS): Basic EPS for Q4 FY25 was ₹16.98, an 11.8% decline compared to the same period last year.

- Large Deal Wins: The Total Contract Value (TCV) of large deal wins for FY25 reached $11.6 billion, with 56% being net new deals. In Q4 FY25, the TCV of large deal wins amounted to $2.6 billion.

- Dividend Announcement: The company’s board recommended a final dividend of ₹22 per equity share for the financial year ending March 31, 2025, a 13.2% increase over the previous year.

Comparative Analysis of Q4 FY25 and Q4 FY24

Here’s a table summarizing the key financial figures for Q4 FY25 and Q4 FY24:

Factors Influencing Performance

Several factors contributed to Infosys’s Q4 FY25 performance:

- Geopolitical Uncertainties: The company cited “geopolitical uncertainties” as a factor affecting its results.

- Global Economic Headwinds: Infosys’s CFO, Jayesh Sanghrajka, acknowledged “navigating through multiple headwinds in a challenging macro environment”.

- Potential US Tariffs: Concerns about potential US tariffs and their impact on client spending have added to the uncertainty.

- Wage Hikes: Analysts anticipated that wage increases for junior employees would put pressure on profit margins.

- Sector-Specific Challenges: The company experienced weakness in the automotive sector, particularly in Europe, and reduced client spending in the retail and high-tech sectors.

Revenue Guidance and Outlook

Infosys has provided a conservative revenue growth guidance of 0% to 3% in constant currency terms for the financial year 2025-26. This is a significant downward revision from the previous guidance for FY25, which projected 4.5% to 5% growth. The company attributed this cautious outlook to the prevailing uncertainties in the global markets.

Comparative Performance

A comparison with Infosys’s competitors reveals the following:

- Wipro: Projected a revenue decline in the range of -1.5% to -3.5% for the first quarter of FY26.

- Tata Consultancy Services (TCS): Reported a 5.3% year-over-year revenue increase in Q4 FY25, with a 1.6% decrease in net profit.

Analyst and Market Sentiment

The FY26 revenue growth guidance was met with disappointment from analysts. Concerns were raised about the revenue de-growth in Q4 and the muted guidance for FY26. The market reaction on the NYSE was negative, as reflected in the decline in the ADR price.

Management Commentary: Key Takeaways

CEO Salil Parekh’s Strategic Focus

- Generative AI Leadership:

- Cost Optimization Push:

- Vertical-Specific Growth:

CFO Jayesh Sanghrajka on Margins

- “We will protect margins through a mix of pricing revisions, automation, and reduced fresher hiring.”

- Plans to cut travel costs by 25% in FY25 via virtual client meetings.

Key Takeaways

- Infosys’s Q4 FY25 results show a decline in net profit despite revenue growth.

- The company’s FY26 revenue growth forecast is conservative due to global economic uncertainties.

- The ADR price decline reflects investor concerns about profitability and future growth.

- The IT services sector faces challenges from macroeconomic headwinds and geopolitical events.

Concluding Remarks

Infosys’s recent performance and future outlook reflect the challenges and complexities of the current global economic landscape. The company’s emphasis on navigating uncertainties and maintaining a cautious stance highlights the need for strategic adaptability in the IT services sector.

Sources

- Infosys ADR drops over 4% on NYSE after IT major’s net profit tanks amid global uncertainty on Trump tariffs | Stock Market News – Mint, accessed on April 18, 2025, https://www.livemint.com/market/stock-market-news/infosys-adr-drops-over-4-on-nyse-after-it-majors-net-profit-tanks-amid-global-uncertainty-on-trump-tariffs-11744896754416.html

- Infosys shares in focus: Should you buy, sell or hold IT major’s stock after Q4 results? EXPLAINED – Mint, accessed on April 18, 2025, https://www.livemint.com/market/stock-market-news/infosys-shares-in-focus-should-you-buy-sell-or-hold-it-majors-stock-after-q4-results-explained-11744910477697.html

- Infosys Q4 Results Highlights: Profit drops by 11.75%, final dividend of Rs 22; narrows FY26 revenue guidance to 0-3% – Industry News | The Financial Express, accessed on April 18, 2025, https://www.financialexpress.com/business/industry-infosys-q4-results-live-updates-profit-revenue-attrition-key-announcements-3812282/

- Infosys Q4 FY25 results: Profit slips 12% to Rs 7033 crore; revenue climbs 8%, accessed on April 18, 2025, https://www.businesstoday.in/markets/stocks/story/infosys-q4-fy25-results-profit-slips-12-to-rs-7033-crore-revenue-climbs-8-472450-2025-04-17

- Infosys Q4 Results 2025: From profit, revenue to dividend— 5 key highlights of March quarter earnings | Stock Market News – Mint, accessed on April 18, 2025, https://www.livemint.com/market/stock-market-news/infosys-q4-result-profit-at-7-033-crore-5-key-highlights-11744881946151.html

- Infosys Q4 net profit falls 11.7% to Rs 7033 crore; revenue rises to Rs 40925 crore, accessed on April 18, 2025, https://timesofindia.indiatimes.com/business/india-business/infosys-q4-net-profit-falls-11-7-to-rs-7033-crore-revenue-rises-to-rs-40925-crore/articleshow/120380442.cms

- Infosys reports Q4 PAT at Rs 7033 cr, Rs 22/sh dividend announced; guidance for FY26 at 0–3% growth in CC terms – The Economic Times, accessed on April 18, 2025, https://m.economictimes.com/markets/stocks/live-blog/infosys-ltd-q4-results-infy-q4-fy25-tata-elxsi-hdfc-life-revenue-earning-profit-loss-dividend-today-report-date-time-17-april-2025/liveblog/120368592.cms

- Infosys: Growth of 4.2% in CC, operating margin expansion of 0.5% in FY25 – PR Newswire, accessed on April 18, 2025, https://www.prnewswire.com/in/news-releases/infosys-growth-of-4-2-in-cc-operating-margin-expansion-of-0-5-in-fy25–302431566.html

- Infosys Limited (INFY) Q4 2025 Earnings Call Transcript | Seeking Alpha, accessed on April 18, 2025, https://seekingalpha.com/article/4775944-infosys-limited-infy-q4-2025-earnings-call-transcript

- Infosys Limited American Depositary Shares (INFY) Stock Price, Quote, News & History, accessed on April 18, 2025, https://www.nasdaq.com/market-activity/stocks/infy

Disclaimer: The opinions and recommendations mentioned above reflect the perspectives of individual analysts or brokerage firms and do not represent the views of DhimanHub. Investors are strongly encouraged to consult with certified financial experts before making any investment decisions.

#Infosys #Q4Results #ITSector #IndianIT #StockMarket #EarningsReport #ProfitDecline #RevenueGrowth #Guidance