Hindustan Unilever Limited (HUL) Q3 FY2025 Results: Revenue, Profit, and Segment Analysis

Financial Highlights

Revenue Growth

Hindustan Unilever Limited (HUL), India’s largest FMCG company, reported a consolidated revenue of ₹15,559 crore for the quarter ended December 31, 2024. This reflects a 1.9% growth compared to ₹15,259 crore in the same quarter of the previous fiscal year.

Net Profit

The company recorded a consolidated net profit of ₹2,984 crore, representing an 18.9% increase from ₹2,509 crore in the corresponding quarter last year.

EBITDA Margin

The EBITDA margin stood at 23.5%, showing a marginal decline of 20 basis points year-on-year. Despite inflationary pressures, HUL maintained healthy profitability.

Segment-Wise Performance

1. Home Care

- Growth: Achieved a 6% underlying sales growth, driven by strong volume growth in Fabric Wash and Household Care.

- Liquids Portfolio: Continued its double-digit growth trajectory.

2. Beauty & Wellbeing

- Performance: Modest 1% growth.

- Hair Care: Mid-single-digit competitive volume growth.

- Skin Care: Impacted by a delayed winter season, affecting seasonal product sales.

3. Personal Care

- Decline: Registered a 4% decline due to lower sales in the hygiene segment of Skin Cleansing.

- Strategic Actions: Measures are underway to rejuvenate growth in this segment.

4. Foods

- Flat Growth: Packaged Foods grew mid-single-digit, while Ice Cream sales remained flat year-on-year.

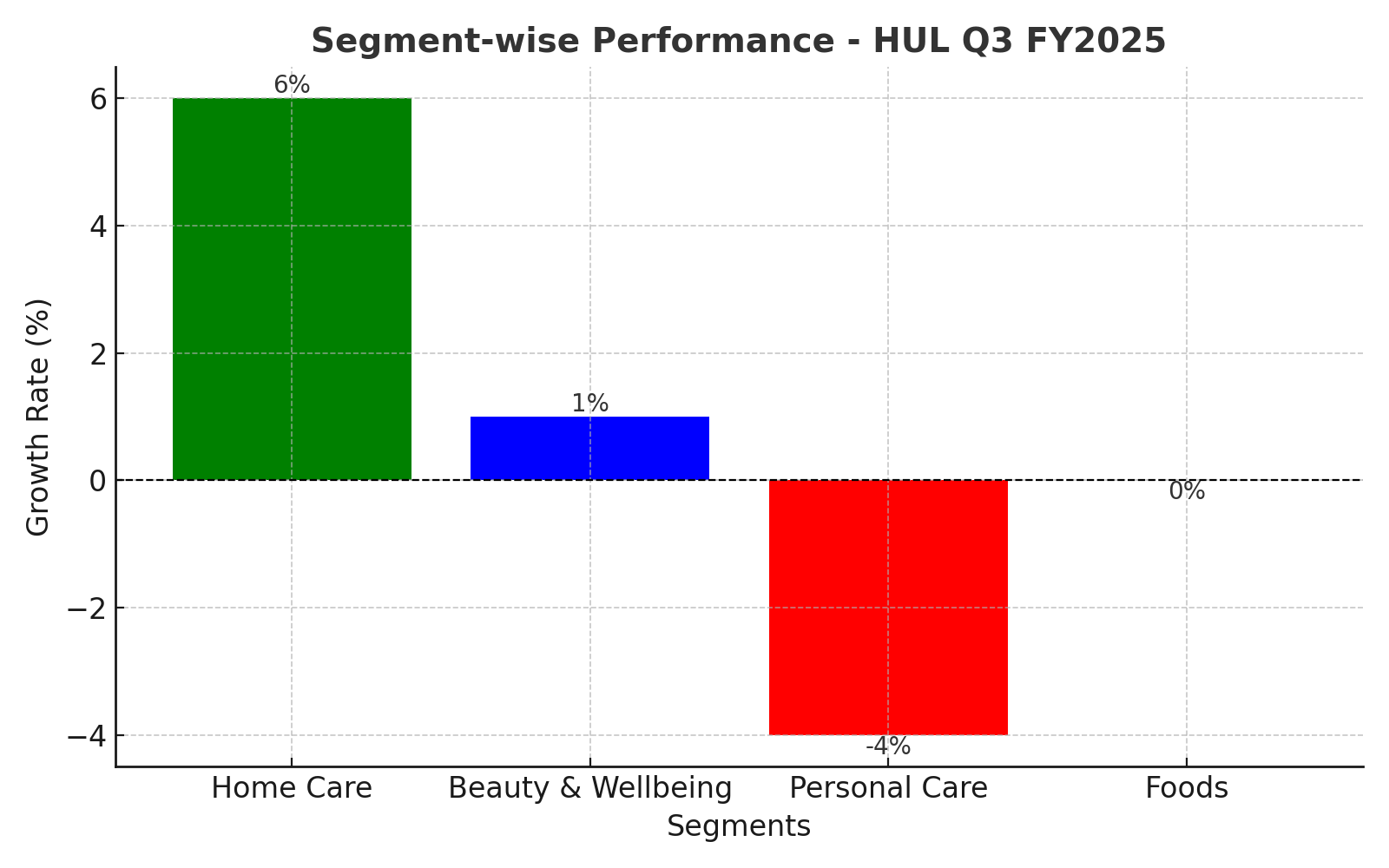

Graphical Analysis

Segment-Wise Performance Chart

Below is a graphical representation of the segment-wise performance for Q3 FY2025:

HUL Q3 FY2025 Results

The chart highlights:

- Home Care is leading with 6% growth.

- Beauty & Wellbeing showing modest growth at 1%.

- Personal Care facing a decline of 4%.

- Foods segment reporting flat growth.

Strategic Developments

Acquisition of Minimalist

HUL acquired a 90.5% stake in Uprising Science, the parent company of the skincare brand Minimalist, for approximately ₹2,955 crore. This acquisition strengthens HUL’s presence in the premium beauty segment, which is experiencing significant growth in India.

Demerger of Kwality Wall’s

The company approved demerging its ice cream business into a standalone entity, Kwality Wall’s (India) Limited (KWIL). Shareholders will receive one share of KWIL for every share held in HUL. This move aims to enhance operational efficiency and focus within the ice cream category.

Market Insights

Rural Recovery

Rural markets, contributing about 40% of HUL’s revenue, showed promising recovery aided by favorable monsoons and government welfare schemes. Growth in rural areas outpaced that in urban markets during the quarter.

Festive Boost

Strong festive demand during Diwali and Christmas was key in driving revenue growth, particularly in the Foods and Home Care segments.

Manmohan Singh’s Remarkable Journey: From Reformer to Beloved Leader, Dies at 92

Challenges and Opportunities

Challenges

- Subdued Urban Demand: Urban growth moderated, impacting overall demand trends.

- Inflationary Pressures: Rising input costs continue to challenge margin management.

Opportunities

- Strengthening its premium beauty portfolio with the Minimalist acquisition.

- Focused strategies in the ice cream and packaged foods segments to drive future growth.

Management Commentary

Rohit Jawa, CEO and Managing Director of HUL, stated:

“FMCG demand trends remained subdued with continued moderation in urban growth while rural sustained its gradual recovery. In this operating context, we delivered competitive growth by driving unmissable brand superiority, investing behind brands and capabilities whilst maintaining healthy margins.”

Insights and Implications

HUL’s Q3 FY2025 results highlight its resilience and strategic focus in a challenging economic landscape. Initiatives like the acquisition of Minimalist and the demerger of Kwality Wall’s emphasize HUL’s commitment to innovation and growth. With a recovering rural market and a strong product portfolio, HUL is well-positioned to seize emerging opportunities in India’s dynamic FMCG sector.

Key Highlights of Hindustan Unilever Q3 Results 2025

- Revenue and Profit:

- Hindustan Unilever (HUL) reported a 19% year-on-year rise in net profit to ₹3,001 crore.

- Revenue saw a modest growth of 1% YoY, reaching ₹15,408 crore.

- EBITDA climbed 1% YoY to ₹3,570 crore, with margins holding steady at 23.15%.

- Segment Performance:

- Home care segment grew 5.4% year-on-year, contributing significantly to overall revenue growth.

- Beauty, wellbeing, and personal care segments together brought in 36% of the revenue.

- Food and refreshments contributed 24%.

- Challenges and Trends:

- The company faced challenges with raw material inflation, particularly palm oil and tea prices.

- Smaller packs are moving off the shelves faster than larger packs, indicating a shift in consumer behavior.

- Premium products, especially in body wash, serums, and coffee, saw double-digit growth.

- Market Reaction:

- Shares of HUL closed nearly flat on the BSE at ₹2,341, reflecting muted investor sentiment.

- The stock has given 13% returns in the last five years against Sensex’s 85% returns.

Sources

- Hindustan Unilever Press Release: HUL Q3 Results 2025

- Business Standard: HUL Q3 FY2025 Financial Results

- Reuters: HUL Reports Q3 Results

- ET Now News: HUL Q3 Earnings Highlights